City Saves Taxpayer Dollars by Retiring Bonds Early

Published on November 25, 2025

Powell City Council has approved legislation authorizing the early redemption of the City’s Refunding Bonds, Series 2015—an action that will save money and reinforce responsible financial management.

This decision closes a major chapter in a large-scale public–private partnership that shaped the development of Powell’s western growth area. In 2002, the Liberty Community Infrastructure Financing Authority was formed, and the City agreed to support the effort by lending its investment-grade bond rating. The goal was to enable the Authority to finance new development at competitive borrowing costs while limiting direct burdens on the City’s general fund.

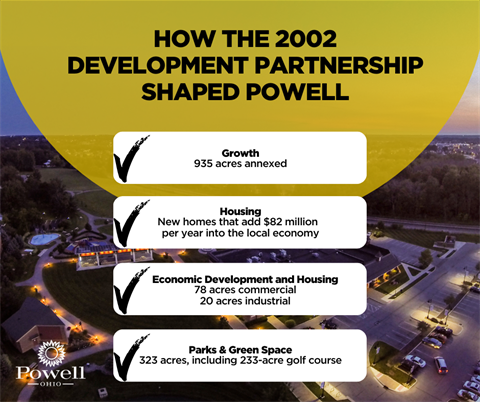

As part of the partnership, Powell approved the annexation of approximately 935 acres, laying the groundwork for a long-term development plan that included:

-

Around 1,200 housing units across single-family homes, condominiums and multifamily neighborhoods (514 acres) that funnel $82 million dollars per year into the local economy

-

78 acres of commercial and office development that allowed around 20 new businesses to locate to Powell, contributing hundreds of jobs and millions of dollars of payroll

-

20 acres of industrial land

-

90 acres of open space, in addition to preserved recreational land

-

233 acres of golf course facilities

This investment enabled the construction of critical public infrastructure, including utilities and the extension of Sawmill Parkway from Seldom Seen Road to Home Road. That work opened up new residential, commercial and employment areas and contributed to a transformation of the community. Over two decades, Powell’s jurisdictional footprint and population expanded significantly, with the area generating hundreds of millions of dollars in private development and public resources.

The City’s population grew by approximately 10,000 residents as a direct result of this long-term planning and infrastructure investment.

In 2015, the City refinanced the original 2002 bonds to secure more favorable interest terms, issuing just over $5.6 million in refunding bonds. Today, $1.695 million of those bonds remain outstanding and become eligible for early redemption in December 2025.

City leadership and the Liberty Community Infrastructure Financing Authority have jointly determined that paying off the remaining debt on December 19, 2025, will produce measurable cost savings. The Authority has agreed to use revenues generated from development charges within the affected area to fund the outstanding principal, accrued interest, and administrative costs associated with the redemption.

This means Powell can retire the remaining debt without drawing additional dollars from the general fund.

“This decision reflects the City’s commitment to smart financial stewardship and protecting taxpayer dollars,” said City Manager Andy White. “By acting now, we are reducing long-term debt and improving the City’s financial flexibility, allowing us to invest more effectively in services and infrastructure that benefit residents.”

The ordinance authorizes the City Manager and Finance Director to carry out all necessary administrative actions, including notification of bondholders and execution of financing documents. If the bonds are not redeemed on schedule, available funds will be returned to the Authority unless both parties agree to extend the timeline.

By advancing the payoff now, the City strengthens its long-term financial position by:

-

Lowering overall debt obligations

-

Reducing future interest exposure

-

Freeing capacity in future budgets

-

Demonstrating proactive, responsible fiscal leadership

The early redemption marks the successful completion of a 20-year public investment strategy that fueled the community’s growth, expanded the City’s tax base, and positioned Powell for continued financial stability.